DIGITAL ONBOARDING

At Leoro, we streamline the digital boarding process for APAC merchants through our integrated eKYC system. This comprehensive flow ensures efficient, secure, and compliant onboarding, allowing merchants to start transacting quickly. Here’s an overview of the process:

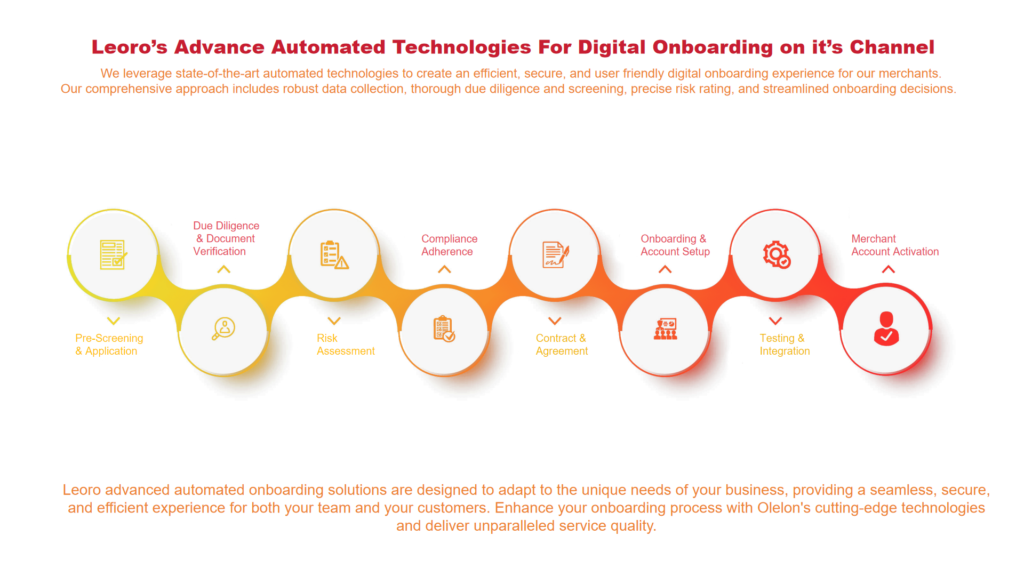

Leoro's Advanced Automated Technologies for Digital Onboarding in Banks

We leverage state-of-the-art automated technologies to create an efficient, secure, and user friendly digital onboarding experience for our banking customers. Our comprehensive approach includes robust data collection, thorough due diligence and screening, precise risk rating, and streamlined onboarding decisions.

Our Experience

Our Roadmap To Reach Your Easy Payment Solution

Discover our detailed roadmap designed to lead you to an effortless payment solution, outlining every step we take to simplify and streamline your financial transactions. quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum.

How We Work

Comprehensive Data Collection

Personalized Checklists

Automatically generate detailed checklists tailored for each new customer to ensure a smooth onboarding process.

Personalized Checklists

Automatically generate detailed checklists tailored for each new customer to ensure a smooth onboarding process.

Personalized Checklists

Automatically generate detailed checklists tailored for each new customer to ensure a smooth onboarding process.

Thorough Due Diligence and Screening

Database Integration

Seamlessly log customer information and verify it against government databases to ensure compliance and accuracy.

KYC and AML Compliance

Automate Know Your Customer (KYC) and Anti-Money Laundering (AML) checks to minimize risk and ensure regulatory adherence.

Blockchain Technology

Implement blockchain solutions to securely store and transfer customer data, enhancing transparency and security.

Accurate Risk Rating

Automated Risk Assessment

Use sophisticated systems to automatically assess and assign risk levels based on comprehensive analysis of customer data.

Predictive Analytics

Leverage predictive analytics to identify potential risks and fraud indicators, enabling proactive decision-making.

Customizable Risk Algorithms

Tailor risk assessment algorithms to meet specific business requirements, ensuring accurate and relevant evaluations.

Let's Start Today

Connected With All The Banks You Need

Seamlessly connect with a comprehensive network of banks worldwide, ensuring you have access to all the financial institutions you need for smooth transactions and reliable support.

Subscribe Our Newsletters

Stay updated with the latest news, insights, and updates from Leoro. Our newsletter brings you valuable information on industry trends, new features, and exclusive offers. Subscribe now to keep your business ahead with Leoro’s expert insights and updates.